Overstating the Financial Risks of Climate Change

On the use of extreme scenarios in the burgeoning field of climate risk analysis

By Jessica Weinkle

A leading story in the Wall Street Journal’s financial section last week extolled Bill Gates’s numerous climate investments. The underlying message was clear: there’s big money in climate change.

This idea should be at least somewhat familiar. New technologies to aid the energy transition and build a more ecologically principled economy implies big investment opportunities. In fact, the climate change policy arena was originally conceived with a nod to trading markets (remember cap and trade?).

But it is important not to lose sight of how this financial interest may distort climate change research and authoritative scientific assessments like those of the Intergovernmental Panel on Climate Change (IPCC) and the National Climate Assessments (NCA).

Extreme Emissions

If you’ve followed the emission scenarios debate in recent years some of this part will be familiar.

Back in very early 2020, Zeke Hausfather, then of BTI, and Glen Peters of the Center for International Climate Research in Norway, argued in Nature that the most common emission scenario used in climate change science was misleading; the emissions in the scenario were implausibly high. Their argument followed on earlier work by Justin Rickie and Hadi Dowlatabadi that showed that the emissions scenario depended on a long outdated assumption about energy markets leading to artificial conclusions about coal use. Researcher Matthew Burgess and colleagues expanded on additional problems in the underlying socioeconomic assumptions of the scenario. Then, in 2022, Roger Pielke, Jr and colleagues, identified a range of plausible emission scenarios available to the IPCC. They identified the upper bound of that range as that which is often used as a moderate policy success story.

In the midst of this, Christopher Schwalm and colleagues, all from the Woodwell Climate Research Center, argued in PNAS that the extreme scenario was reasonable. Rather, it was the views of the other researchers that were “skewed.” The Woodwell researchers had not disclosed their work as consultants for McKinsey and Company, one of the largest consulting firms in the world, for which the researchers had led an analysis of climate physical risk using the extreme scenario they were now defending. Using the scenario, McKinsey made major media headlines with a report that prophesied a tanking of the Florida mortgage market due to climate change.

After the rash of McKinsey reports flooded the consulting world, Schwalm’s coauthor Philip Duffy received a position as Climate Science Advisor in the White House’s Office of Science and Technology Policy (OSTP). In turn, last year, OSTP acknowledged the plausibility debate and decided to justify the continued use of extreme emissions across federal agencies anyway because the “corresponding simulated climate futures cannot be ruled out,” never mind that their underlying assumptions are known to be false.

More recently, at the bottleneck of the worldwide climate change science community, researchers simultaneously advised deprioritizing extreme emissions while also giving reason to keep them around—advice that was promptly met with the decision to continue prioritizing extremes. This has direct implications for IPCC reporting because the only way into the IPCC is through that bottleneck.

Under Pressure

One reason extreme emissions scenarios may be so difficult to ditch is because of the climate analysis consulting business, which depends on them and constitutes the link between scientists and the business community. The climate change consulting business is valued at $2.2 billion, and is forecasted to reach well over $7 billion by 2033.

Extreme scenarios appear to be the industry’s bread and butter. The United Nations Environment Programme Financial Initiative (UNEP-FI) has grown alongside the financialization of climate change risk since the 1990s. In technical documentation from 2023 for their annual Climate Risk Landscape reports, UNEP writes:

Vendors often employ high emission scenarios such as the RCP 8.5 scenario. These worst-case scenarios underscore the potential financial implications of failing to address climate change effectively, and help clients grasp the magnitude of potential losses and adopt appropriate risk mitigation strategies.

The scenarios are not “worst case,” they are fanciful. And they are not used “often.” They are used almost universally. Writing in 2021, UNEPFI showed that of the 19 climate analytic firms surveys, all of them used an extreme emission scenario. The continued dependence on climate extremism is apparent in online marketing material.

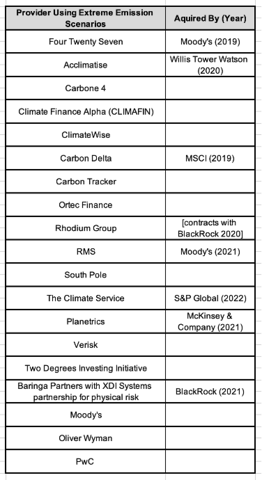

UNEP 2021 provided a list of companies and their scenarios and I adapted that data to this table with information from news reports on acquisitions

Certainly, climate analytic firms will sell whatever emission scenario the client would like to buy. However, justification for using a so-called ‘mid-range’ scenario depends on the legitimacy of the extremes (you can’t have a mid without a high). In other words, so long as the high extremes remain legitimate, what is really the upper bound of plausible will be construed as moderate.

Symbiosis

When outdated science (ie. extreme scenarios) shows up in contemporary policy and regulation, it shines a light on the symbiotic relationships that hold together the belief system.

In 2021, U.S. President Joe Biden signed an executive order directing government wide analysis, disclosure, and management of climate related financial risk. The language of the executive order reflects the work of the Task Force on Climate-Related Financial Disclosures (TCFD). TCFD was initially developed in 2015 at the behest of Bank of England’s governor Mark Carney, while he was also head of the G20 Financial Stability Board. Michael Bloomberg chaired the TCFD, and its final recommendations were to use climate risk analysis in corporate disclosures.

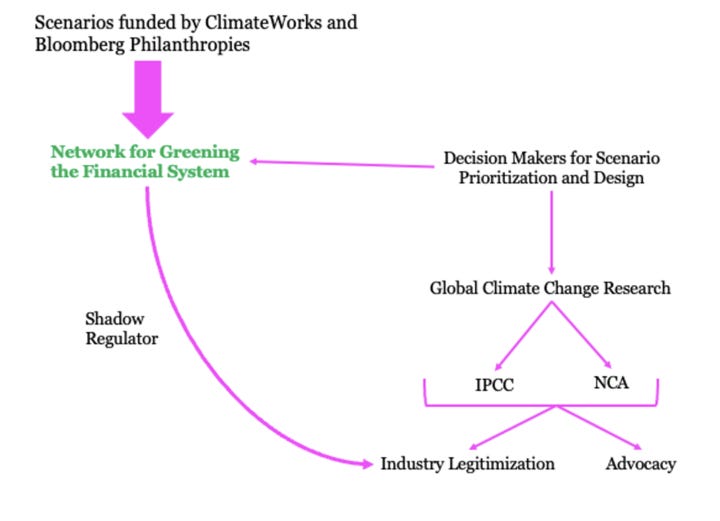

Carney also helped found the Network for Greening the Financial System (NGFS), a coalition of central banks, which developed its own emission scenarios for use by financial regulators in climate risk analysis. Bloomberg Philanthropies and ClimateWorks provided funding for the development of NGFS scenarios—which uses extreme emissions scenarios.

The researchers that created NGFS scenarios are also some of the same people that make decisions about the prioritization and design of scenarios for climate change research with direct implications for IPCC reporting (remember the bottleneck?). This is a clear conflict of interest.

It is a conflict of interest that the researchers making decisions about scenario prioritization and development also create scenarios for central banks and other major financial interests. The consortium that organizes development of the scenarios for the IPCC has a specific Scientific Working Group on Scenarios for Climate-related Financial Analysis that is explicitly motivated by the needs of TCFD and NGFS.

So, not only is there a bottleneck with a handful of people controlling scenarios that influence how the world understands climate change, but many of the same people work with industry that depends on those scenarios. The image below shows the conflicts of interest problem.

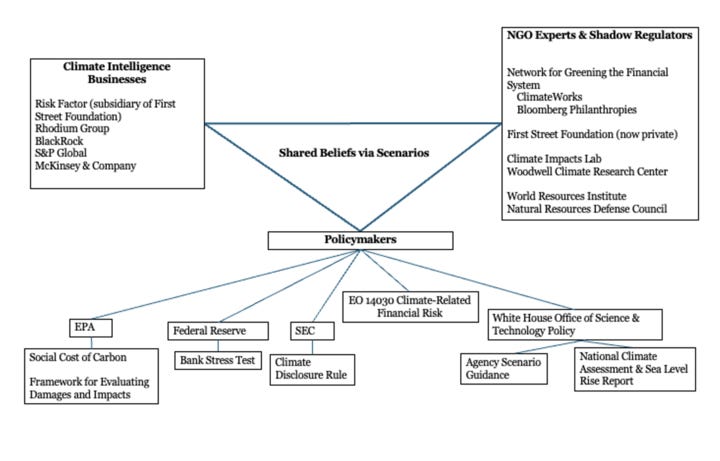

To carry out part of his executive order, Biden charged his climate adviser, Gina McCarthy, formerly president of Natural Resources Defense Council (NRDC), and his economic adviser, Brian Deese, formerly Global Head of Sustainable Investing at BlackRock, to lead the organization of a government-wide approach to climate financial risk.

NRDC (and other establishment environmental groups) and BlackRock were loud advocates among their respective networks for introducing climate change analytics into the financial system. For instance, NRDC called for US financial regulators to join the NGFS and the Sierra Club gathered public comment in support of the SEC climate disclosure rule.

Bloomberg’s work in climate financial risk analysis originated with a politically motivated risk modeling project he helped fund with investor and activist Tom Steyer, and Hank Paulson, with the intention of making climate change feel real and urgent to the business community. As was standard at the time, the project forecast an extreme emission scenario as the inevitable future if the world did not usher in a rapid change in investment priorities.

The project turned out the Climate Impacts Lab, a collaboration between private consultant Rhodium Group and several university researchers: Solomon Hsiang (Berkeley), Robert Kopp (Rutgers), and Michael Greenstone (Chicago). Hsiang and Kopp have both had leading roles as authors to official U.S. National Climate Assessment reports, and Kopp is closely involved in the development of federal sea level rise scenarios (which feed into the NCA).

BlackRock uses Climate Impacts Lab/Rhodium work in its financial risk analytics. And the work of the Climate Impacts Lab—along with the extreme emission scenario—is at the heart of the EPA’s social cost of carbon (SCC) calculation. The SCC is used to economically value the work of Greenstone’s carbon offset firm.

Climate Impacts Lab’s research has also become a key part of the First Street Foundation climate risk analytic services used widely in advocacy and, particularly real estate. Modeling from the First Street Foundation is reportedly embedded in the financial risk management activities of 30 government agencies including government enterprises that back U.S. mortgages.

In all this, the clearest evidence of regulatory capture has come in the form of the recent passage of a rule by the Securities and Exchange Commission requiring the use of climate analytics in the financial disclosure filings of certain companies. Emissions scenarios, in other words, now have mandated customers.

The system of shared beliefs and how it is held together in science and policy is shown below.

Arizona’s Oceanfront Property

There are many problems with this arrangement.

The first is the obvious problem of stymied and captured climate change science. Sound science is essential for good policy and democratic accountability. When science falters, everything else can come down with it.

The second is the confusion over climate risk. Although climate change does affect weather, economic losses from extreme weather have to do with our socioeconomic conditions and decisions about the built environment. The effects of climate change on current and future weather pale in comparison to the effects of our decisions about how, what, and for whom we build.

Third, investment decisions guided by risk analytics using extreme emissions scenarios are decisions guided by bad science. Finance matters; it creates opportunity for individuals and society. Our global experience shows that when uncertainty and ignorance in the financial system goes unmanaged, major problems arise all around the world. Introducing known false assumptions into investment decisions unnecessarily introduces uncertainty into the system.

Fourth, where people are using extreme emissions scenarios, they are also engaging in a theoretical modeling practice of no real meaning. Where people are using a common mid-range scenario because it seems more sensible than the extreme, they are nonetheless taking a high-end view of risk. This all seems incredibly inefficient.

Finally, I can think of no better illustration of environmentalism as a special interest: extreme emissions scenarios bring together an eager coalition of scientists, environmental groups, and the financial industry in hot pursuit of regulations that build business sectors to employ climate quants.