Angular Momentum

How NGOs and advocates spun a narrative of a climate change uninsurability induced economic crisis

There is a loud advocacy campaign these days arguing that climate change is undermining the insurability of risks and this will create an economic crisis akin to the 2008 global financial crisis. To halt these pending dark days we must make changes to our energy supply and call out the “dark money fossil fuel influence operation.”

This is a startling belief system of cause and effect. Over a decade ago, Dan Sarewitz, wrote about a slightly different spin on the climate story and the equally remarkable belief system it embedded. Recalling of a conversation he had with a neighbor, Sarewitz writes

when you think about it, this view of things is made up of an incredibly complex mélange of confirmed facts (his direct observations), accepted facts (from authorities he trusts), beliefs, superstitions, nonsense, norms, and values which he integrates into what is for him a coherent world view.

A critical think on the insurance argument finds that it aims to directly pit US energy policy against US economic policy. Very few stand to win a fight like this but then, very few made a fortune in the 2008 financial crisis.

In this post, I will explain from where this bizarre advocacy campaign is currently emanating. In the recent year or two the voices spinning the story have become increasingly concentrated creating louder and faster spin. Hence, the angular momentum analogy.

This post is related to my previous post

The central problem in the climate change-losses-uninsurability connection is that it is false, of course.

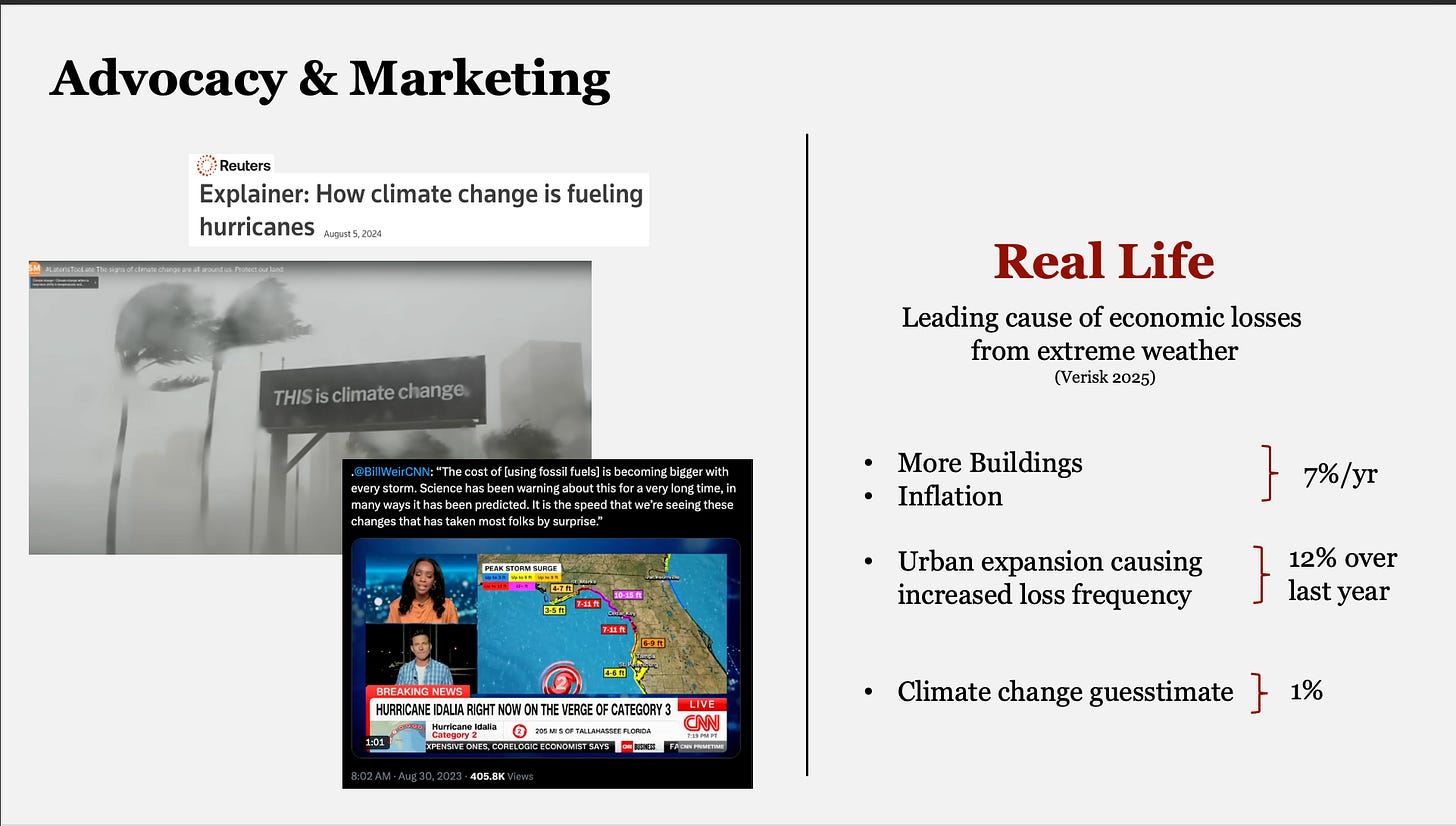

Data from a recent Verisk report shows that when it comes to explaining losses in real life there is disconnect between advocacy messaging and data analysis. The image below is mine showing common advocacy messaging on the left compared to Verisk reporting on the right.

Verisk suggests a 1% estimate for climate change influence on losses, which it describes as an estimate. A year or so ago, Swiss Re used the same as a high level estimate. I believe there is enough wiggle room in the loss trends that 1% is more of a virtue signal than anything concrete. Even still, 1% is not a leading cause of insurance affordability problems.

There is also a “huge gap between what you’d read in the IPCC Working Group 1 chapter on extreme weather and what you see in a lot of media” as Patrick T Brown explained on PBS Energy Switch, recently.

The image above is of an Axios hosted event during Climate Week and the UN Climate Summit. The woman on the left is an Axios journalist and the woman on the right is Abby Ross, CEO of The Resiliency Company which claims to, “the funding, policies, and innovation required to shift markets and minds toward resiliency.”

Resiliency Company partners with the groups below. The set up is not unusual. There is some sort of opaque-ish funding source, a dedicated marketing arm, an analytics provider, and then a policy advocacy group. And everyone is a 501(c)(3).

Scratch the surface only slightly here and there is just a bunch of the same ol’ advocacy groups. Probable Futures is a partnership with Woodwell Climate Research Center. Insurance for Good brings together reps from the reinsurance industry with reps from Environmental Defense Fund, Woodwell, and Climate Impacts Lab (a 501c3 since several years ago), along with some other notables. Climate Impacts Lab has been very influential in US social cost of carbon calculations, US sea level rise scenarios, and the continued commitment of US researchers to implausible emission scenarios.

In the Axios interview image above that Potential Energy is a sponsor. And so, represented in this one image of the two women speaking is not just the organizations listed above but some others, too.

Potential Energy Coalition, is an NGO “marketing firm whose mission is to dramatically increase public support for action on climate change.” It was originally established by the Windward Fund and continues to receive funding from there. In 2023 Potential Energy received $13 million from Windward.

Potential Energy has a partnership with Yale Program on Climate Change Communication (YPCCC), and members of the later sit on the board of the former.

Together Potential Energy and YPCCC developed the “Unnatural Disasters” message to increase public perceptions of attribution between extreme weather events, disasters and climate change. This then became part of a messaging guide developed with Climate Central, an NGO that claims to provide imagery and messaging on climate change to 95% of US media outlets.

YPCCC has been on a tear recently testing the messaging efficacy and public perceptions of these sorts of things:

climate change attribution to extreme weather

connection between climate change and homeowners insurance costs

predictors of climate protests (e.g. anger and worry)

So, in a nutshell, here is Windward fund pushing money into Potential Energy to develop advertising using YPCCC research and disseminated on Climate Central’s network. All of it is designed to bring together into the public mind attribution of extreme weather and anthropogenic climate change. Climate Central also brought forth the World Weather Attribution project to support pursuit of climate litigation. See also here

The Axios event at the Climate Summit presented several speakers who, for the exception of Tom Steyer, connected climate change to insurance costs and ultimately, economic crisis.

DeltaTerra Capital founder and CEO David Burt

Insurers are starting to hike premiums, and some lenders are starting to think about increasing insurance requirements.

First Street chief economist Jeremy Porter

The insurance angle is an intent to be less political:

The very interesting thing about going directly after people’s real lives, their real costs, especially locally, is that you have an impact for both conservatives and progressives alike. That’s going to happen even more.

Potential Energy Coalition CEO John Marshall

paraphrased as explaining that insurance costs could make it easier to convey the dangers of climate change to the public because,

It’s a decently simple message, because insurance starts to resonate across America — ‘Your town could be next.’

Senator Sheldon Whitehouse (D-RI)

appeared to indicate that this messaging will become part of the Democratic party platform because:

You have a chance to say these guys have not been listening to you in all of your economic distress about [insurance costs]. Instead, the’ve been lying to you because their pockets are full of fossil fuel money. And you connect the cost part of the argument and the corruption par of the argument. And I think it’s powerful. And I hope that it wins a bunch of races.

Tom Steyer, investor and climate activist

If you stay with me a moment I will to complete the circle a bit.

When I first wrote about Potential Energy it was because I started down the lane towards understanding the forces coming together to create climate anxiety. These are some of those forces.

Potential Energy runs the Science Moms campaign that leverages mothers’ concern for the wellbeing of their children’s future to get moms to talk about climate change with their families. The project features the drama above based on the Unnatural Disasters messaging concept.

There is also the wheezing child video, the Later is Too Late campaign and the 2025 Super Bowl ad. The going rate for 30 seconds of ad time during this year’s Super Bowl was $8 million. Potential Energy/ScienceMoms ran a 1 minute ad. Just saying.

Under the Biden Administration, First Street provided analytics to 30 government agencies and featured prominently in various reports out of the Senate Budget Committee under the leadership of Senator Whitehouse.

Folks at Climate Impacts Lab (remember from above) also worked with First Street Foundation in its early years.

First Street is now a private company receiving investment from Tom Steyer’s VC firm. This is interesting because Climate Impacts Lab is born out of a politically oriented research project originally developed, in part, by Steyer and Michael Bloomberg, to make climate change feel real for businesses. Results from that project was fast adopted into the Fourth National Climate Assessment, and there was also a sea level rise collaboration with Climate Central.

First Street also received investment from Eric Schmidt’s VC firm. This is interesting because the Schmidts founded and support Climate Central.

First Street’s risk rating product, Risk Factor, is embedded in Zillow and Redfin. There are grumblings on the interwebs that the analytics are causing trouble for buying and selling homes, and thus brining about the economic impacts it promised to predict.

Some may argue that this is just more information for consumers to make decisions. But, there are grumblings that the analytics are of dubious quality (e.g. downscaling).

Still more, Zillow and Redfin may be a questionable place for unregulated climate change risk analytics given the significance these platforms have for the real estate market. This year, Zillow has faced four lawsuits alleging antitrust and market competition violations- one of which included a partnership with Redfin.

There may well be a problem with the affordability of insurance because our disasters are so expensive and most salaries don’t increase at the same pace as inflation. But the core problem is not climate change, no matter how concerning we may find anthropogenic influence on the climate.

As I just laid out above, the climate change piece in the insurance narrative is a political marketing scheme intended to support elections, litigation, and perhaps a few investors.

I’ve written more about related topics here:

Behind the rise of climate anxiety in children and young people

A Climate Dumpster Fire: How climate change advocacy threatens public safety and American prosperity

*Today, Noonish: I slightly edited my subheading for clarity

Thank you, Jessica, for keeping on shining light on the climate industrial complex. This is immensely important. For reference, here is what president Eisenhower said in 1961 about a similar but, on a global scale probably less metastesized phenomenon: “ In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes. We should take nothing for granted. Only an alert and knowledgeable citizenry can compel the proper meshing of the huge industrial and military machinery of defense with our peaceful methods and goals, so that security and liberty may prosper together.”

The Climate Scam is a Magic Money Tree...The fake science has been fabricated to lend an aura of respectability...is easily disproved and perpetuated by people who have no concept of some quite basic scientific principles...THAT IS WHY THEY PERPETUATE THE SCAM...