The value of Florida real estate to the state and nation

When debating Florida's insurance regime it is rare for anyone to mention the value of its real estate market

The NYTimes has a podcast covering the Florida windstorm (i.e. hurricane) insurance market. It did a nice job sharing the standard narrative about the history of Florida’s propped up hurricane insurance market that keeps its real estate based economy chugging along.

It also added to the story, rightfully so, by pointing to the importance of homebuying to the American public for wealth creation and towards the end of the show, turning some attention to urban design.

What the podcast did not mention, which the standard narrative never mentions, is that if Florida’s uniquely designed hurricane insurance market is propping up the state economy then it is also propping up the US economy.

In 2021, Florida GDP was over $1.2 trillion. Of this, at least 30% is tied to real estate: 25% came from real estate, finance, and insurance, and another 5.4% comes from construction. So yes, Florida has a real estate driven economy.

Florida is the fourth largest state contributor to US GDP and ontributes about 5% to overall US GDP.

The hurricane prone region of the “southeast” is the largest regional contributor to national GDP, at about 22%. Florida is the largest contributor to that region.

Of Florida’s GDP, a whopping 30% comes out of the Miami Metropolitan statistical area- basically, Miami-Dade and Broward counties. Another 13% or so comes from the Tampa area.

About 45% of Florida GDP is coming from areas that are not just prone to hurricanes but prone to very high losses when landfalls occur. For instance, if the 1926 Great Miami hurricane were to occur today it is estimated to run well over $200 billion or over 50% of the Miami area’s GDP.

But for every year that the event doesn’t occur, Florida- and arguably the nation- reaps the GDP benefits of all the meshugaas that is the Sunshine State.

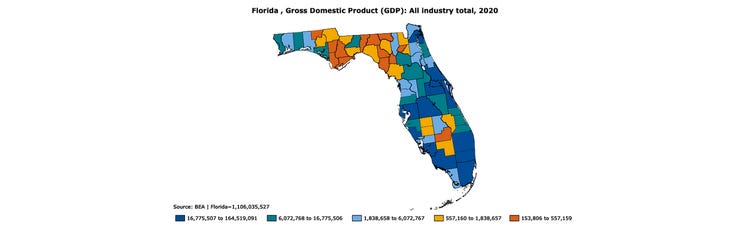

The map at the top of this post shows county contributions to Florida GDP. Note the big blue region in South Florida.

From a policymaker perspective, a curious hurricane insurance regime may be more favorable than re-designing the US economy. It certainty avoids upsetting the real estate lobby that contributes handsomely to political leanings of all stripes.

*Update (1/19/23)…

In more recent developments, Bloomberg notes that Florida has the highest percentage of unmortgaged homes than any other state in America. The Florida Legislature passed a bill to requiring Citizens Property Insurance Corporation policyholders to buy flood cover.