On SVB, the Fed, and climate stress tests

The Fed's climate stress exercise may have begun as symbolic politics but, in the aftermath of SVB the exercise bolsters claims of regulatory capture

Thank you for your patience as I tended to my family this past month.

“The highest function of love is that it makes the loved one a unique and irreplaceable being.”

-Tom Robbins, Jitterbug Perfume

SVB

Like many, I read with interest about the crash of Silicon Valley Bank (SVB) and the government’s response. As the story unfolded, commentary came to focus on poor oversight by the Federal Reserve. It’s not that SVB blatantly failed to engage with standard things to manage interest rate risk, so say the commentaries, it is that regulators did nothing to make them change their ways.

According to the WSJ editorial board, the Fed should have seen the problem coming in the banking sector after 13 years of near zero interest rates that were rapidly increased in a short period of time. But, as the WSJ points out,

the Fed’s “severely adverse scenario” stress test in February 2022 forecast a hypothetical world in which the three-month Treasury rate stayed near zero while the 10-year Treasury yield declined to 0.75%. This suggests the Fed staff in Washington were oblivious to risks from rising interest rates.

Interesting…

A History of Controversy Around the Federal Reserve Stress Test Scenarios

As it turns out, there is a history of controversy around the scenario design of the Federal reserve stress tests.

Commentary from different viewpoints suggests that stress testing could be an important risk management tool, but as a now 15 year institutional practice, it has become a highly technical political performance.

It seems neither regulators nor banks have any interest in a stress test that foreshadows… well, stress.

Banks and regulators implemented stress testing in a piecemeal fashion starting around 1992. But, says Office of Financial Research (OFR) researchers, “Pre-crisis stress tests were not only limited in scope… but also suffered from a failure of imagination.” According to OFR, there was a general all around refusal to consider possible the conditions of past experience during the Depression (i.e. house price declines).

Congressional response to the 2008 financial crisis with the Dodd-Frank Act of 2010 made stress testing a regulatory tool of the Federal Reserve. Even still, stress testing was not mandated until after an initial exercise and capital raising for which banks could then show resilience to the tests.

Originally, Dodd-Frank required three scenarios: 1) Baseline, 2) Adverse, and 3) Severely Adverse. Under the Trump Administration, these were whittled down to two: Baseline and Severely Adverse.

At least by 2015, researchers with the OFR pointed to problems with the predictability of the stress test process leading the entire system to divert attention from systemic financial risk to model management,

Despite the complexity of this process… we find that projected losses by bank and loan category are fairly predictable and are becoming increasingly so… Indeed, consulting firms and software vendors have made a business of trying to simplify and standardize the stress testing process for banks to make it more routine.

…whereas the results of stress tests may be predictable, the results of actual shocks to the financial system are not, and herein lies the concern.

The Fed’s stress testing was also the subject of a 2016 GAO report followed up with with a report on its regulatory capture in 2017.

In early 2020, Daniel Tarullo, a former member of the Federal Reserve Board writing for Brookings argued that the Fed’s stress testing practices suffers from “ossification,” lacks substance, and provides limited transparency of test results to the public.

Instead of a dynamic annual stress test, we have increasingly predictable compliance exercises. Instead of building on the [original 2009 stress test] and using stress testing to estimate the losses that could ensue from an extended COVID crisis, a stale scenario is used to allow banks to continue paying dividends. Instead of transparency around meaningful stress test results, the public has only aggregate numbers from a sensitivity analysis whose influence on bank capital policies remains unclear.

Lobbyists for the banking industry also have gripes about the scenarios.

CEO of the Bank Policy Institute, Greg Baer, argues that the test lacks substance and needs more transparency for the industry around the models and scenarios (so, not the results).

Baer also argues that a component of the severely adverse scenario (i.e. the global market shock scenario) “appear[s] increasingly divorced from logic and market reality.”

A historical and political context for the Fed is offered at BIG by Matt Stoller in his post, “Fire the Fed.”

According to Stoller, while it was always the case that The Fed was uncomfortably entwined with the banks it regulated, there was a significant turning point in the 1980s,

It became ‘independent,’ and explicitly argued it should not be subject to political control or influence… Greenspan restructured the Fed’s supervisory authority, deferring to banks, and ultimately ripping out the culture of aggressive regulation.

The Fed has long shied from the stress tests mandated by Dodd-Frank and sought to get rid of them. Indeed, Stoller points out, despite their interest rate hike decisions they did not develop a stress test to see how those decisions would pan out.

From his perspective then,

The reason the Fed screwed up is ideological. Regulators there simply do not believe in placing constraints over banks, for fear they will hinder American strength… As such, today it is the strength of large banks, as well as ‘financial innovation,’ that matters to the Fed, not the underlying simple utility service of operating payments, making loans, and safekeeping cash.

The Fed Climate Stress Test…er, Climate Scenario Analysis

On a background of existing financial stress testing politics comes the introduction of climate financial risk analysis, and the grand world of climate politics.

In January, the Fed released participant instructions for a Pilot Climate Scenarios Analysis Exercise. The Fed is adamant that the exercise is not a stress test. To the Fed, a stress test has implications for regulation whereas a scenario exercise is “exploratory in nature” and does not have any regulatory consequences. Moreover, for whatever insights the exercise may provide, there is no intention of sharing them with the public,

Consistent with the objectives and design of the pilot exercise, the Board does not plan to disclose quantitative estimates of potential losses resulting from the scenarios included in the pilot exercise. No firm-specific information will be released.

Still, the Fed describes its climate exercise as including “a range of plausible future outcomes” to understand climate related financial risks in large banking organizations.

To this end, the Fed prescribes

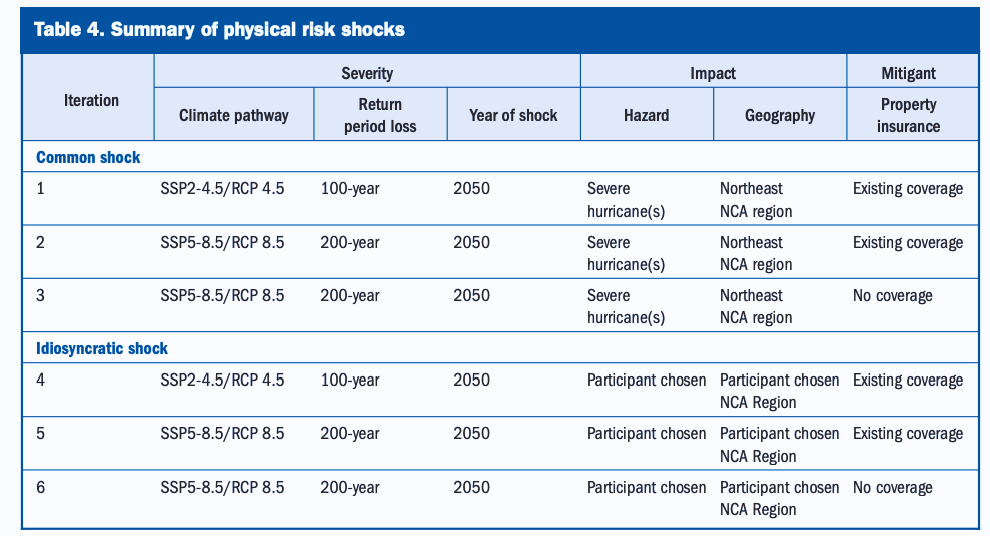

A two part physical risk exercise using IPCC scenarios SSP5-8.5/RCP 8.5 and SSP2-4.5/RCP4.5 to project 2050 conditions, and choosing “a severe hurricane event (or a series of events)” in the Northeast region and an event of choice in a preferred region.

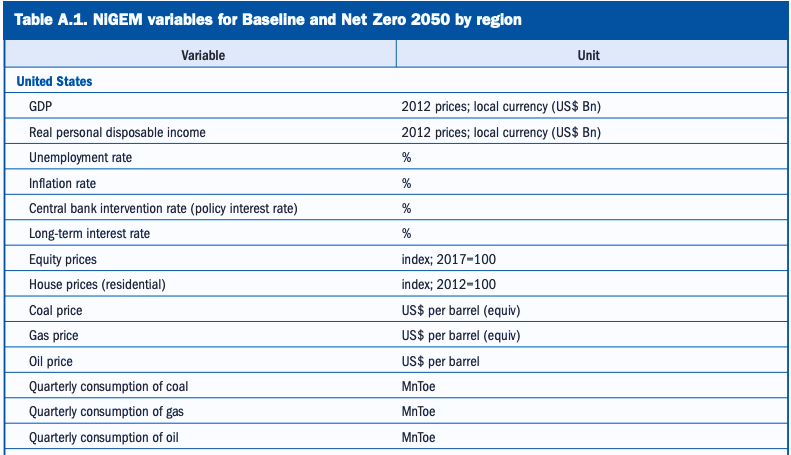

A transitional risk exercise Fed directs the use of NGFS scenarios Current Policies and Net Zero 2050 for risks to 2032.

The image below is the Fed’s synopsis of the physical risk exercise.

We know that SSP5-8.5/RCP8.5 is not plausible and the emissions trajectory in the NGFS Current Policies is also too high.

We know that NGFS Net Zero 2050 relies on carbon dioxide removal practices that “only currently take place on a limited scale and face their own challenges.” And the scenario’s target temperature below 1.5C is not realistic and never was.

So, the only plausible scenario the Fed offered is SSP2-4.5/RCP4.5.

Within this mess…

For physical risk, the Fed appears to leave the banks to decide what the hurricane catalog of events should look like and the damage function to use. They leave them to decide on sea level rise, sea surface temperature, and precipitation.

There are entire careers and industries worth of politics in these decisions.

For transitional risk, the Fed says,

The Federal Reserve understands that participants may not use all the variables provided in the scenario by the NGFS. Participants may transform the provided variables, or may expand to include additional variables, as appropriate.

Here, too, there is much that can be debated about these underlying assumptions, including the $245 shadow carbon price by 2035 and interestingly, I thought, higher home values in a net zero world versus current policies .

Indeed, the Fed tells the banks they can wing it,

In addition, this CSA exercise is a pilot exercise designed to build capacity. Unless participants also rely on a model used in this exercise for business-as-usual decisionmaking, or to assess risks on a regular basis, participants may use models that have not been fully integrated into their model risk-management framework, including those that have not yet been subject to comprehensive model validation.

A window onto regulatory dysfunction

What does it mean for one of the most significant financial institutions in the world, the US Federal Reserve, to implement an exercise evaluating the resilience of behemoth financial institutions to a specific risk using scenarios that lacks substance and clear parameters?

Perhaps, the Fed doesn’t know better. They either didn’t ask (?!) or those that could have advised them (like those on the FSOC climate advisory committee) have no incentive to inform them otherwise.

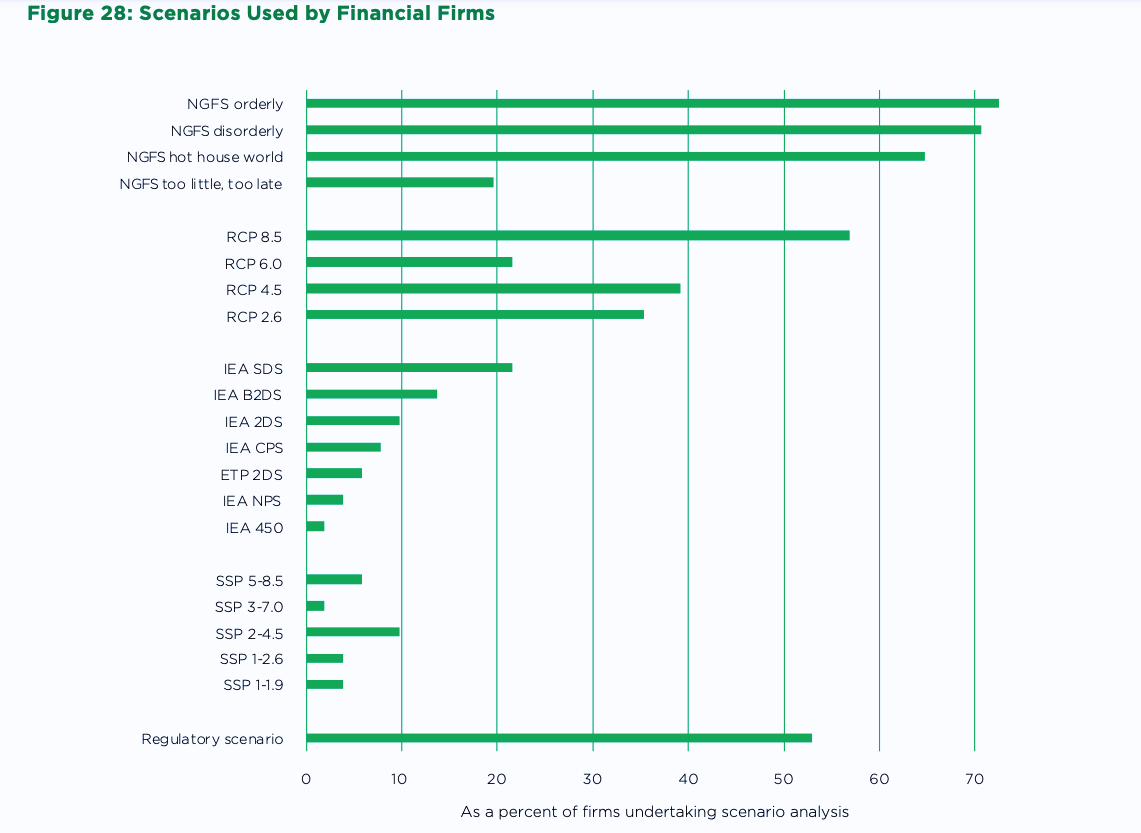

Perhaps, the Fed lacks the will and capacity to overcome the influence of the NGFS, a non-governmental organization whose scenarios are developed with some IPCC scientists with funding from US based advocacy organizations, Bloomberg Philanthropies and ClimateWorks. The Fed is a member of the NGFS and “Adhering to the NGFS reflects a political commitment from an institution and also implies the will and capacity to actively contribute to the work.”

Perhaps, the Fed is a capture of the banks. Its climate exercise serves to validate existing industry practices and the overall concept of climate change stress tests. According to a 2022 survey of 38 banks and 24 other financial firms the Fed’s chosen scenarios are of the most popular among firms (image below). Here is JP Morgan Chase, an entity participating in the Fed’s exercise, using these scenarios (and a slightly different one for net zero) .

Whatever the reason, the Fed’s Pilot Climate Scenario exercise suffers the same concerns that critics of their regulatory stress testing exercise have lamented for some time. The pilot exercise lacks plausibility and substance. It is predictable, favoring the banks and their consultants. There is limited to no public transparency.

The Fed created a politically symbolic exercise paying homage to its NGFS membership without impinging on anything that may be considered ‘financial innovation.’ Remember, according to Silicon Valley venture capitalists, climate science is “the new computer science.” And here is Citi on the climate fintech industry.

Perhaps the Fed's climate stress exercise began as symbolic politics turning out fodder just in time for the 2024 election year. But, in the aftermath of SVB and in the context of a history of stress testing controversy, the its climate exercise serves to bolster concerns about the agency’s capture.

The basic reason why IPCC scenarios SSP5-8.5/RCP 8.5 are wrong is because they are based on a world population of 12 billion in 2100. Current estimates are that the world population will be around the current 8 billion in 2100. With China now losing population and having low fertility rates, they alone will probably lose ~750 million of their current 1.4 billion population. Many other countries are already losing population (South Korea, Japan, Russia, Italy, Spain, ... ).

With the population also rapidly aging worldwide due to low fertility rates, the use of energy per person will decrease, making that scenario even less relevant.