For the past couple of years, Republicans accused asset managers, NGOs, business coalitions of antitrust violations in the area of ESG investing. Of particular interest has been GFANZ and a similar organization, NZAM.

Earlier this month, the House Judiciary Committee launched an investigation also roping in BlackRock and Vanguard. I similar investigation occurred in 2022 around ClimateAction 100+.

companies appear to have potentially violated U.S. antitrust law by coordinating and entering into collusive agreements to “decarbonize” assets under management and reduce emissions to net zero

The legitimacy of the investment activity rests on reporting by the IPCC and climate policy negotiations at the UN level.

The pressure of major financial firms on scientific integrity in climate change science is substantial and, I believe, it is hindering the ability of the field to right itself and move beyond extreme emission scenarios.

Recently, the head of Oxford’s Sustainable Finance Group, Ben Caldecott, announced to the world via the Financial Times that pressure from financial firms is undermining academic freedom in ESG research.

The rabbit hole that legislators have stumbled upon runs deep. It should be treated as more significant than political theatre for election campaign fodder.

A fruitful public discussion will avoid polarizing, bombastic rhetoric and look seriously at what has become of climate change science and its relationship to the financial industry.

The discussion should aim to improve accountability of scientists… and not just climate change scientists but much of the science profession.

1. How the IPCC’s Outdated Scenarios Became the Foundation of ESG Investing

A potent political narrative holds that in order to avoid “dangerous” climate change global CO2 emissions need to halve by 2030 and reach net zero by 2050 so that global warming does not exceed 1.5C.

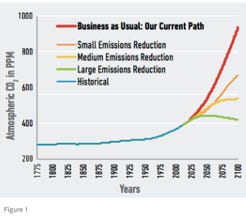

The urgent narrative is rooted on the temperature time path trajectories of outdated scenarios. The IPCC 5th Assessment Report reported that under the implausible and extreme emission scenario RCP8.5, the world would cross the a 1.5C global warming temperature threshold between 2046 and 2065.

The IPCC was directed to provide a special report to legitimize the carbon stocktake process towards the political artifact that is the 1.5C target.

The final report, Special Report on Global Warming of 1.5C created a clear point for crossing the 1.5C temperature threshold: the year 2040.

Together- outdated emission scenarios and the politically determined temperature target- create a stick and carrot for an explosion in climate related ESG accounting practices.

2. The Use of Outdated Emission Scenarios to Acquire Regulation

Around 2013, Michael Bloomberg, Tom Steyer, and Hank Paulson headed up a research project known as the Risky Business Project. Each of them had “his own particular goals for the initiative, all of which would be served by making making the climate threat feel real, immediate and potentially devastating to the business world.”

The project catapulted the use of the RCPs as different policy scenarios despite RCP developers noting that differences between them “cannot be directly interpreted as a result of climate policy.” The Risky Business Project also embedded a significant amount of COI into the National Climate Assessments.

Just before the release of the first report of RBP, Michael Bloomberg became increasingly involved in international climate change policy negotiations and climate risk disclosure standard setting.

During Paris Agreement negotiations, Mark Carney, then the Chairman of the Financial Stability Board and Governor of the Bank of England, announced the creation of a Task Force on Climate- Related Financial Disclosure (TCFD), “to make recommendations for consistent company disclosures that will help financial market participants understand their climate-related risks.” Carney placed Bloomberg as TCFD chairman.

An important moment of convergence of political influence, financial interests, and development of IPCC science becomes evident at this time.

Released in June 2017, TCFD recommendations emphasized the use of climate scenarios to assess the resilience of an organization’s investment strategy with a specific preference for temperature pathways. A few months later, TCFD and BoE hosted a two-day workshop encouraging the use of climate scenarios in risk management and directly engaged at least one lead author of SR15.

By the end of the year, Carney had announced another initiative, the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) “to help strengthening the global response required to meet the goals of the Paris agreement.... and conducts or commissions analytical work on green finance.”

The TCFD and NGFS worked in tandem mutually reinforcing their legitimacy.

Then, in 2021 during COP26, Carney and Bloomberg, developed the Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of financial firms representing $130 trillion in assets.

GFANZ encouraged financial intuitions to commit to UNFCCC’s Race to Zero campaign of halving global emissions by 2030 to reach the specious Paris Agreement temperature target of 1.5C. Race to Zero was initially co-led by Nigel Topping, a former executive of the CDP, chief executive of We Mean Business, and “instrumental” in the launch of SBTi.

Similarly, several large global reinsurance firms launched the Net Zero Insurance Alliance (NZIA) in 2021 at the G20 Climate Summit in Venice. The NZIA committed members to setting science based emission reduction targets namely through the use of SBTi.

3. Climate change science organizes around financial interests

The money for NGFS scenario development came from Bloomberg Philanthropies and ClimateWorks. A good overview of the evolution of NGFS scenarios is here. Cooked deep within the scenarios is the use of RCP8.5 (using work that cites Risky Business Project products).

Authors of the NGFS scenarios engage lead authors of the IPCC and a technical advisor to SBTi.

The potential for sprawling conflicts of interest between the financial industry and the climate change researchers community is evident in the development of a Scientific Working Group on Scenarios for Climate related Financial Analysis in the IAMC.

The IAMC (Integrated Assessment Modeling Consortium) was created in response to an IPCC call in 2007 for a research organization to lead the IAM community in the development of new scenarios used by climate modelers. Those governing the activities of the the IAMC have a significant amount of influence on global climate change research activities.

In their own words, the IAMC Scientific Working Group on Scenarios for Climate-related Financial Analysis is

based on the recognition that the IAM community can be a key provider of scenario information and guidance for climate-related financial analysis. It is mostly scenarios from research institutions that form the basis of scenario information for reports by the Intergovernmental Panel on Climate Change (IPCC), which in turn is the key scientific input to international climate negotiations under the United Nations Framework Convention on Climate Change (UNFCCC) and national policy discourses.

So, to put it bluntly: Researchers working to organize the development of scenarios for use in IPCC reports are also doing developing scenarios for the financial industry including the influential NGFS.

And the legitimacy of the climate risk investment activities rests on work of the IPCC.

Of note, the 2022 meeting of the IAMC received sponsorship from the Bezos Earth Fund and ClimateWorks.

4. Consolidating the regulatory regime

In 2011, the Sustainability Accounting Standards Board (SASB) was founded with a focus on US financial disclosure practices set by the Securities and Exchange Commission (SEC). Bloomberg “was a key supporter of SASB, having been involved with the group since its inception in 2011.”

Bloomberg and Mary Shapiro served as Chair and Vice chair of the SASB board from 2014-2018. Shapiro has an executive role at TCFD, is long time advisor to Bloomberg, vice chair of GFANZ, and former chair of the SEC.

Bloomberg’s support of SASB was joined by, among others, Tom Steyer via his own philanthropy, TomKat Charitable Trust, major accounting consultancies, and Al Gore’s asset management firm, Generation_.

Mergers took place rapidly beginning in 2020.

The International Integrated Reporting Council (IIRC), an alliance among leading international standards setters, announced a merger with SASB. This resulted in the Value Reporting Foundation (VRF).

ClimateWorks, advised by a member of the TCFD Secretariat and former head of Bloomberg LP Sustainable Business and Finance Group, supported SASB in the merger with IIRC.

VRF (and CDSB) merged to create the International Sustainability Standards Board under the International Financial Reporting Standards (IFRS) .

As co-vice chair of VRF, Mary Shapiro was engaged with the IFRS merger.

The mergers with IFRS is a significant development because IFRS sets most of the world’s global accounting standards. The key exception to nation’s abiding by the IFRS is the United States where standards are set by the SEC using the GAAP, Generally Accepted Accounting Principles.

Antritrust violations?

I wouldn’t know.

A sprawling business and regulatory endeavor built entirely atop outdated scenarios in IPCC reports?

Certainly looks that way to me.

A growing problem of COI among climate researchers and industry?

I believe so.

If course corrections for science mean people- powerful people- lose money and decades worth of effort to “acquire” regulation then the stakes are quite high for the IPCC to learn much of anything new.

And that’s a problem. Scientific knowledge should be able to evolve… rich rich people might become less rich.

Jessica, this is great! Thanks for reporting. Please don't leave out the insurance industry.. "the worse things are in the future, the more we can charge upfront.."

Or the USG using info from foundations that hasn't been ground-truthed or subject to the Data Quality Act. https://forestpolicypub.com/2023/02/22/ceq-uses-first-streets-wildfire-risk-maps-instead-of-us-government-maps-in-ej-screening-tool-why/

Thank you for pointing out the various conflicts of interest in the ESG-Finance-Industry space. Last week, the FSB announced that the ISSB will take over the monitoring of TCFD aligned companies. https://www.ifrs.org/news-and-events/news/2023/07/foundation-welcomes-tcfd-responsibilities-from-2024/

The new ISSB/IFRS Sustainability and Climate related Financial Disclosure Standards S1 and S2 essentially embed GFANZ pledges into accounting, thus effectively doing an end-run around anti-trust accusations. Although the US will likely not adopt the ISSB standards, the EU's Corporate Sustainability Reporting Directive (CSRD) is aligned with the ISSB, thus American companies dealing in the EU or with EU companies will have to comply. Canada is also considering adpoting the ISSB standards thus American companies operating in Canada will have to comply. The SEC is also on the ISSB Jurisdictional Working Group and there is some indication that it is working to align the forthcoming climate rules with the ISSB. https://www.ifrs.org/groups/jurisdictional-working-group/#members

Of note, the big four accounting firms along with the WEF, IASB, CDSB, TCFD, VRF, were consulted on and helped draft the standards, then submitted comments supporting the standards, and some are listed as stakeholders wanting the standards.

At every opportunity, ISSB board members and supporters repeat the mantra that there's an urgent need for, and stakeholders are demanding, a new global language, a new global standard. But when pressed and asked who exactly is clamouring for this, which stakeholders in particular, there is either silence or a general statement of "investors" or "banking" or "capital markets".

There is a very real tightening and global standardization of ESG-style financial disclosures that will affect US companies even with the various counter-legislative measures introduced so far. Those companies currently voluntarily using TCFD reporting guidelines or the CDP or GRI questionnaires and metrics will also be pulled into this new global language since the CDP will use the ISSB disclosures, plus, the GRI has an MOU with the ISSB to collaborate on incorporating the ISSB disclosures with the GRI metrics.